What is PMI, When Do You Have It on a Mortgage, and How to Get Rid of It

When purchasing a home, you may encounter the term "PMI," or Private Mortgage Insurance. While it’s a common aspect of many mortgages, it’s essential to understand what PMI is, when it applies, and how you can eventually eliminate it.

What is PMI?

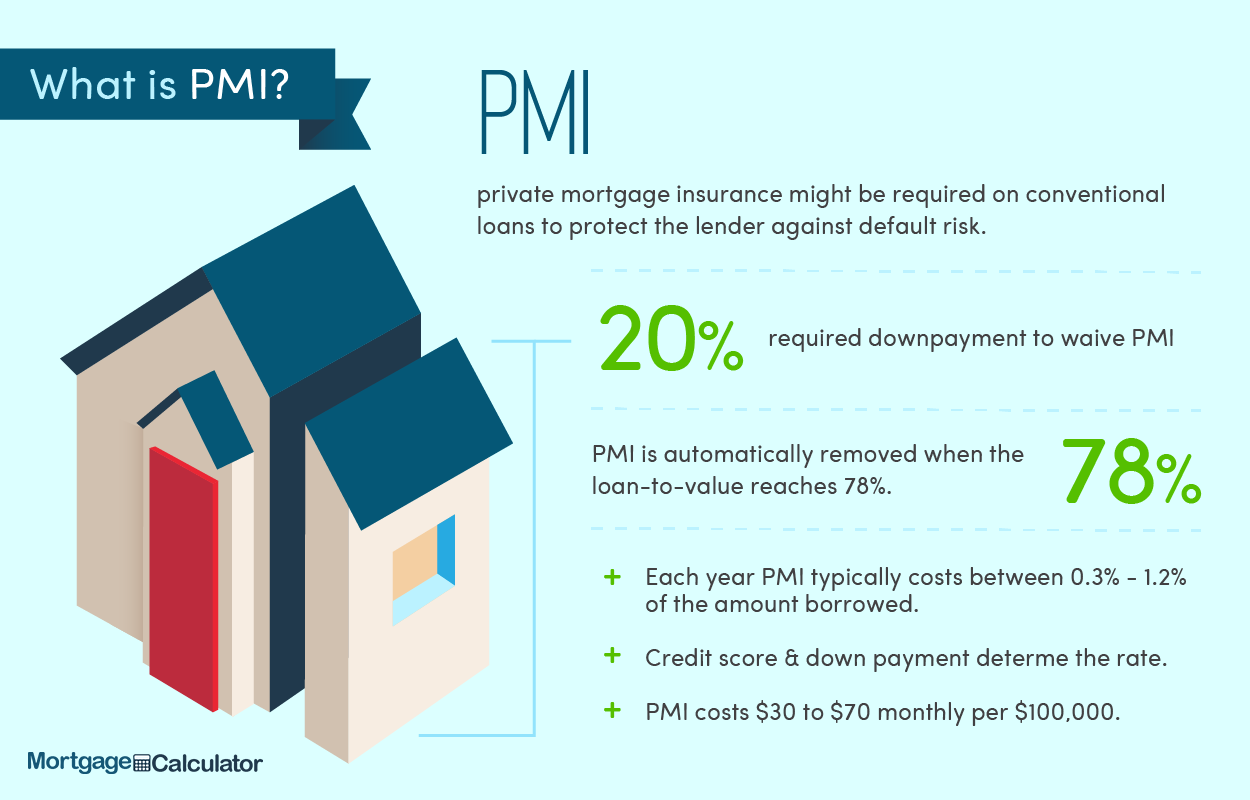

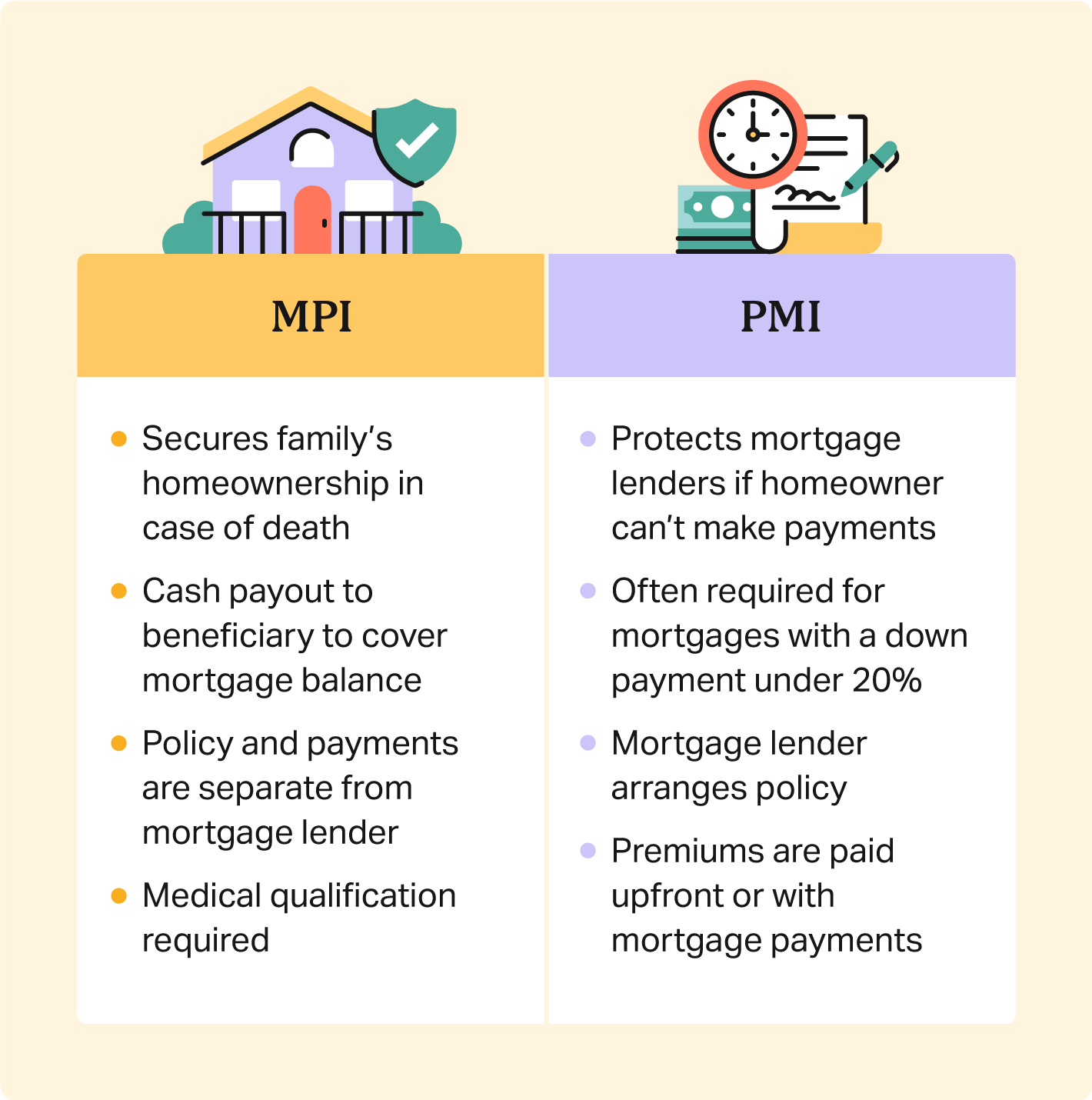

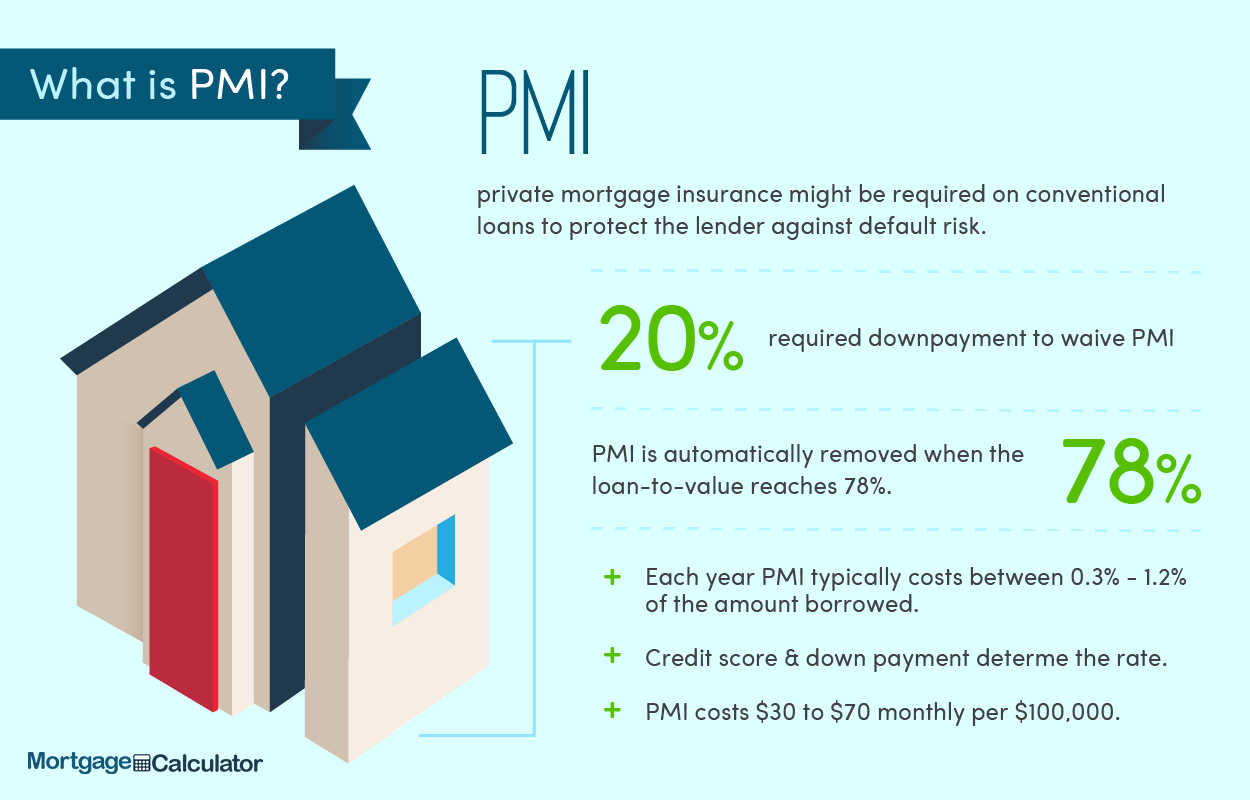

Private Mortgage Insurance (PMI) is a type of insurance that protects the lender in case the borrower defaults on the mortgage. PMI is typically required when a borrower makes a down payment of less than 20% of the home’s purchase price.

For lenders, borrowers with smaller down payments represent a higher risk, so PMI helps mitigate potential losses. However, PMI doesn’t benefit the homeowner directly. Instead, it’s an added cost to the borrower, either as a monthly fee, an upfront payment, or a combination of both.

When Do You Have PMI on a Mortgage?

You’ll typically be required to pay PMI in the following scenarios:

- Conventional Loans with Less Than 20% Down: PMI is most commonly associated with conventional loans when the borrower’s down payment is less than 20% of the home’s value.

- Refinancing with Insufficient Equity: If you’re refinancing your home and your equity is below 20%, PMI may also apply.

- Low-Down-Payment Loan Programs: Some programs, such as those catering to first-time homebuyers, may allow for down payments as low as 3%, which will almost always require PMI.

How Much Does PMI Cost?

PMI costs vary depending on factors such as:

- The size of your down payment

- Your credit score

- The loan amount

On average, PMI premiums range from 0.3% to 1.5% of the original loan amount annually. For example, if your loan is $250,000 and your PMI rate is 0.5%, you could pay about $1,250 per year or roughly $104 per month.

How Do You Get Rid of PMI?

The good news is that PMI doesn’t last forever. Here are the primary ways to eliminate it:

- Automatic Termination: By law, your lender must automatically cancel PMI once your loan-to-value (LTV) ratio reaches 78% of the home’s original value (assuming your payments are up-to-date). This means you’ve paid down enough of the loan to own at least 22% equity in the home.

- Borrower-Initiated Removal: You can request to cancel PMI once your LTV reaches 80%. This typically requires you to contact your lender and possibly provide evidence, such as a new home appraisal, to prove the home’s value.

- Refinancing: If your home’s value has significantly increased or you’ve paid down enough of the loan, refinancing into a new loan without PMI may be an option. However, ensure that the savings outweigh the refinancing costs.

- Reaching the Loan’s Midpoint: If you’re on a fixed-payment schedule, PMI must be removed at the loan’s halfway point, even if you haven’t reached the 78% LTV threshold.

Is PMI Always Required?

No, PMI is not required for every mortgage. For example:

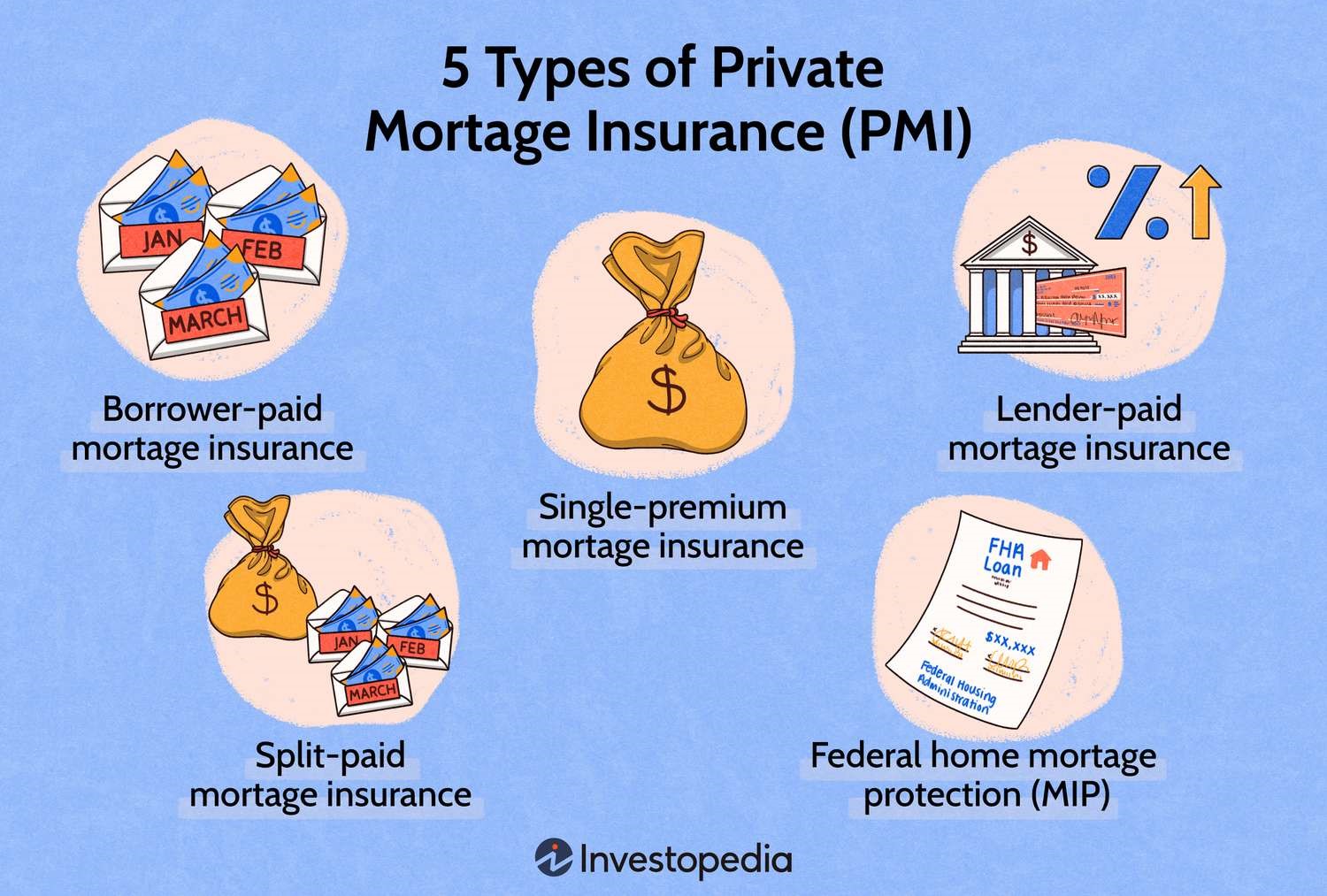

- FHA Loans: Instead of PMI, FHA loans have their own type of mortgage insurance premiums (MIP), which have different rules and costs.

- VA Loans: Loans backed by the Department of Veterans Affairs do not require PMI, though they may have a funding fee.

- 20% Down Payment: Borrowers who make a 20% or greater down payment on conventional loans avoid PMI altogether.

Final Thoughts

While PMI can be an additional expense, it also opens the door to homeownership for those who might not have the means to make a 20% down payment. Understanding the terms of your PMI and how to eventually eliminate it can help you manage your mortgage more effectively and save money in the long run. Always consult with your lender or financial advisor to explore your options and ensure you’re making informed decisions about your mortgage.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "