A Step-by-Step Guide to Buying Your First Home in Florida

Buying your first home is an exciting milestone, but it can also feel overwhelming, especially if you’re navigating the Florida real estate market for the first time. This guide will walk you through the essential steps to make the process smoother and more manageable.

1. Assess Your Finances

Before you start house hunting, take a close look at your financial situation:

- Check your credit score: A higher score can help you secure a better mortgage rate.

- Determine your budget: Use an online mortgage calculator to estimate what you can afford.

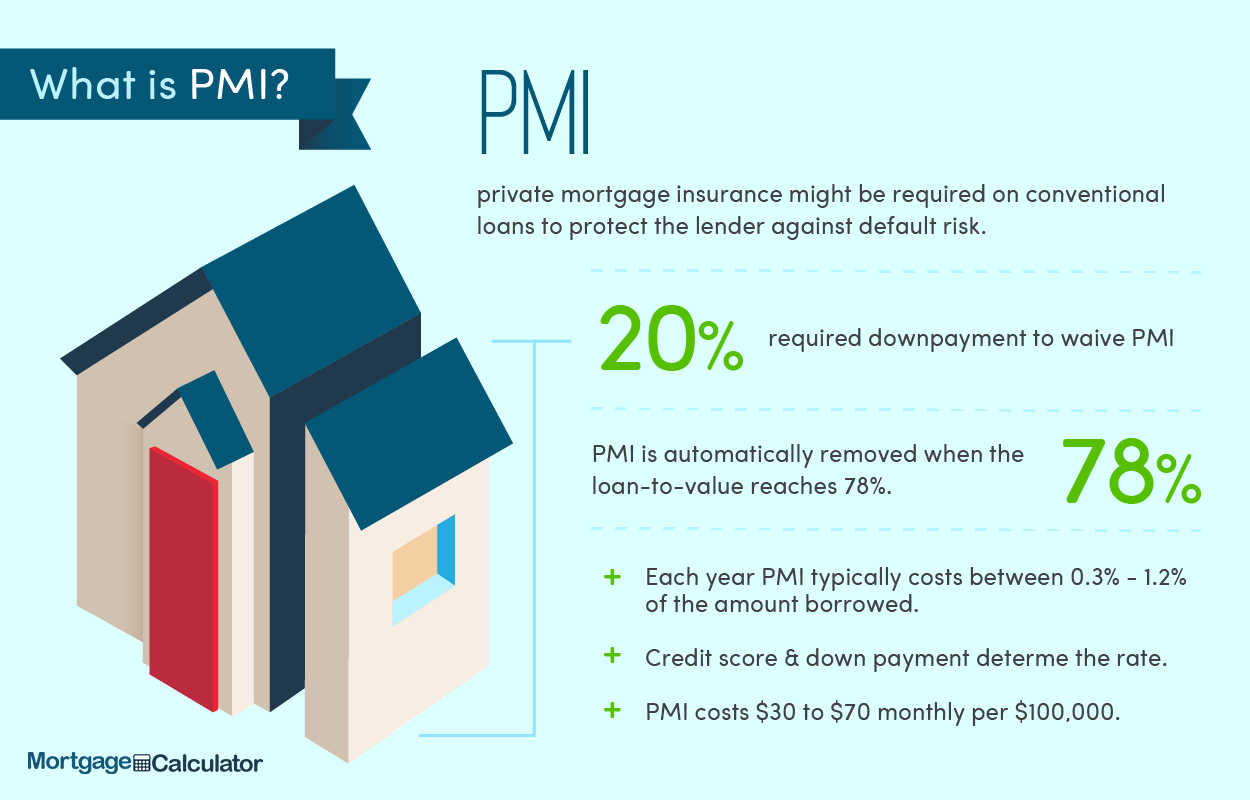

- Save for a down payment: Aim for at least 3-20% of the home’s purchase price, depending on the loan type.

- Set aside closing costs: These typically range from 2-5% of the home’s price.

2. Get Pre-Approved for a Mortgage

Getting pre-approved shows sellers that you’re a serious buyer and gives you a clear understanding of how much you can borrow. To get pre-approved:

- Gather financial documents (pay stubs, tax returns, and bank statements).

- Research lenders to find the best interest rates and terms.

- Submit your application and receive your pre-approval letter.

3. Find a Knowledgeable Real Estate Agent

Partnering with a real estate agent who knows the Florida market is invaluable. They can:

- Help you find homes that meet your criteria.

- Navigate local market trends.

- Assist with negotiations and paperwork.

4. Start House Hunting

Now comes the fun part—looking for your dream home! Keep these tips in mind:

- Make a list of must-haves: Consider factors like location, size, and amenities.

- Research neighborhoods: Prioritize areas with good schools, walkability, and access to amenities.

- Attend open houses: These are great opportunities to explore potential homes and ask questions.

5. Make an Offer

When you find the perfect home, your agent will help you draft an offer. This involves:

- Setting a competitive price based on market analysis.

- Including contingencies for inspections and appraisals.

- Submitting your earnest money deposit to show good faith.

6. Conduct Inspections and Appraisals

Once your offer is accepted, it’s time to ensure the home is in good condition and worth the price:

- Home inspection: Identifies potential issues that may need repairs.

- Appraisal: Confirms the home’s value matches the agreed-upon price.

7. Secure Financing

Finalize your mortgage by:

- Reviewing and signing the loan agreement.

- Locking in your interest rate.

- Coordinating with your lender to prepare for closing.

8. Close the Deal

Closing day is when the home officially becomes yours! During closing:

- Review and sign all necessary documents.

- Pay closing costs and any remaining fees.

- Receive the keys to your new home.

Tips for First-Time Homebuyers in Florida:

- Understand Florida’s market: Florida’s market can be competitive, especially in desirable areas like Miami, Orlando, and Tampa.

- Consider property taxes and insurance: Florida’s property taxes vary by county, and you’ll need to budget for homeowners’ insurance, especially if you’re in a flood-prone area.

- Explore first-time buyer programs: Look into state and local assistance programs for down payment assistance or favorable loan terms.

By following these steps, you’ll be well on your way to owning your first home in Florida. Remember, preparation and the right team of professionals can make all the difference. Happy house hunting!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "