Should You Ask the Seller to Cover Closing Costs or Negotiate a Lower Purchase Price

Should You Ask the Seller to Cover Closing Costs or Negotiate a Lower Purchase Price?

Buying a home is one of the biggest financial decisions you'll make, and every dollar counts. One common dilemma buyers face is whether to ask the seller to cover their closing costs or negotiate a lower purchase price instead. Both options have advantages and drawbacks, and the best choice depends on your financial situation and market conditions.

Understanding Closing Costs

Understanding Closing Costs: What They Are and Why They Matter

When buying a home, the purchase price isn't the only expense to consider—closing costs are a crucial part of the transaction. These fees cover the various services required to finalize the sale and typically range between 2% and 5% of the home’s purchase price. Understanding these costs can help you make a more informed decision about whether to negotiate with the seller to cover them or pay them yourself in exchange for a lower purchase price.

What’s Included in Closing Costs?

Closing costs consist of multiple expenses, and while they vary depending on location and loan type, they generally include:

✅ Lender Fees – These cover the cost of processing your loan, including origination fees, underwriting fees, and discount points if you choose to buy down your interest rate.

✅ Appraisal Fee – Your lender will require an appraisal to determine the fair market value of the property, which typically costs between $300 and $600.

✅ Title Insurance & Title Search – Title companies check the property's ownership history to ensure there are no legal claims or liens. Title insurance protects you and the lender from any ownership disputes.

✅ Escrow Fees – These fees are paid to the third-party escrow company handling the transaction, ensuring all funds and documents are distributed correctly.

✅ Home Inspection Fees – While not always required, a home inspection is strongly recommended to uncover any potential issues with the property.

✅ Property Taxes & Prepaid Insurance – Many lenders require buyers to pay a portion of property taxes and homeowners insurance upfront as part of their escrow account.

✅ Recording Fees & Government Charges – These fees go toward legally recording the deed and mortgage with the county or city.

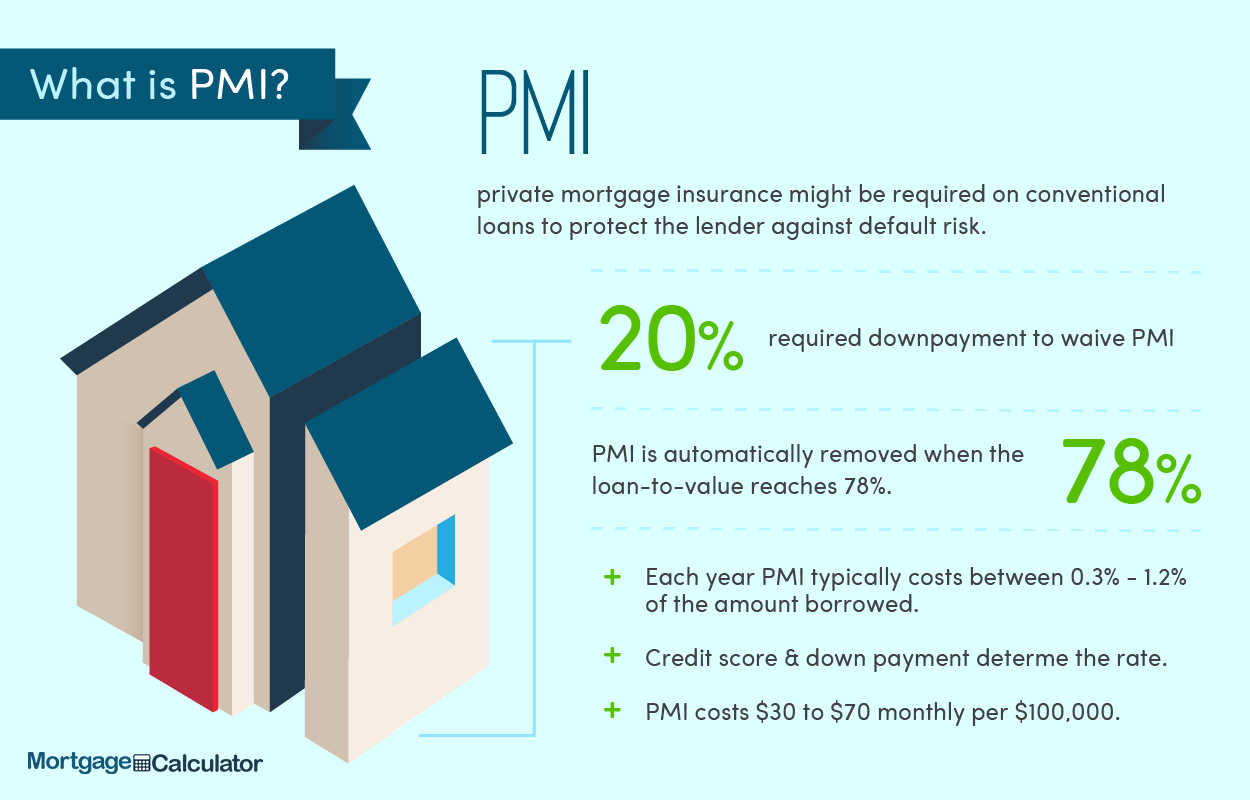

✅ Mortgage Insurance (if applicable) – If your down payment is less than 20%, you may be required to pay private mortgage insurance (PMI), which can be included in your closing costs.

How Much Should You Expect to Pay?

The total closing costs depend on multiple factors, including the home’s price, loan type, and location. Here’s a general idea of what you might expect:

● For a $300,000 home → Estimated closing costs: $6,000 – $15,000

● For a $400,000 home → Estimated closing costs: $8,000 – $20,000

● For a $500,000 home → Estimated closing costs: $10,000 – $25,000

Since these are significant expenses, many buyers try to reduce their out-of-pocket costs by negotiating with the seller to cover some or all of them.

Can Closing Costs Be Rolled Into the Loan?

In some cases, buyers may have the option to roll closing costs into their mortgage instead of paying them upfront. However, this increases your loan amount and monthly payments, meaning you'll pay more in interest over time.

How Can You Reduce Your Closing Costs?

If you’re looking for ways to minimize these costs, consider the following:

🔹 Negotiate Seller Concessions – In a buyer’s market, sellers may agree to cover part or all of your closing costs to help close the deal.

🔹 Compare Lenders – Different lenders charge different fees, so shopping around for a better mortgage rate and lower fees can save you money.

🔹 Ask About Lender Credits – Some lenders offer credits toward closing costs in exchange for a slightly higher interest rate.

🔹 Look for First-Time Homebuyer Programs – Some state and local programs offer assistance with closing costs for first-time buyers.

Option 1: Asking the Seller to Cover Closing Costs

Pros:

✔ More cash on hand at closing – This reduces your upfront expenses, making homeownership more accessible.

✔ Can help if you're tight on funds – If covering the closing costs would deplete your savings, getting help from the seller allows you to keep more financial cushion.

✔ Ideal for first-time buyers – Many first-time homebuyers don’t have large amounts of cash saved up, making seller concessions a great option.

Cons:

✖ May result in a higher purchase price – Sellers might increase the home’s price to offset the closing cost assistance.

✖ Less competitive offer – In a hot seller’s market, buyers who ask for concessions may be less attractive to sellers compared to those who don’t.

✖ Higher monthly mortgage payment – If the home price is slightly increased to cover closing costs, your mortgage payment will be a bit higher over time.

Option 2: Negotiating a Lower Purchase Price and Paying Your Own Closing Costs

Pros:

✔ Lower overall loan amount – A lower purchase price means you borrow less, reducing the amount of interest paid over the life of the loan.

✔ More appealing to sellers – Sellers may prefer an offer that doesn’t include requests for closing cost assistance, especially in a competitive market.

✔ Potential for better equity – If you negotiate a lower price, you start with more equity in your home, which can be beneficial when selling or refinancing later.

Cons:

✖ More out-of-pocket expenses upfront – You’ll need to bring more cash to closing, which could strain your finances.

✖ Might not be an option if funds are tight – If your savings are limited, covering your own closing costs could make the home purchase less feasible.

✖ May take longer to recoup costs – While a lower purchase price helps in the long run, the immediate impact on your cash flow may be challenging.

Which Option is Right for You?

- If you need more cash upfront or are a first-time buyer with limited funds, asking the seller to cover closing costs might be the better choice.

- If you want long-term financial benefits, a lower purchase price could save you money over time.

- The market also plays a role—in a buyer’s market, sellers may be more willing to cover closing costs, while in a seller’s market, a cleaner offer with fewer concessions is more competitive.

Final Thoughts

There's no one-size-fits-all answer, but the best approach depends on your financial situation, mortgage terms, and the current real estate market. If you're unsure which option works best for you, consult with your real estate agent and lender to explore what will give you the most financial advantage.

Still have questions? Let’s connect and find the best strategy for your home purchase!

Ready to dive into real estate success? Contact @tatumpraise for expert guidance in Greater Tampa Bay!Click Here to Subscribe to my YouTube Channel for More Videos About Our Community and the Local Real Estate Market.Please do not hesitate to contact me if you have any questions about this video or the local real estate market. |

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "