Don’t Flop on your first Flip!

First-Time Flippers - do not make this rookie make this mistake when getting into the game. Click the link below to get your numbers right and don’t kill your deal.

Make sure that when you go into your first flip project you aren’t forgetting to account for some major fees that a lot of beginner investors tend to overlook when running numbers. In this blog, we will discuss soft costs, closing fees, and lender charges that quickly add up and can really make or break a deal if the spread isn’t large enough or if they are overlooked when running numbers originally.

Starting first with what I will classify as “Soft Cost.” These are going to be fees associated when purchasing the property and selling the property.

For the purposes of this example, the purchase price of the property will be $200,000.

We will break things down into two separate transaction types, starting first with a straight cash transaction and then moving on to a more in-depth hard money loan situation.

Starting with purchasing the property as a cash purchase and looking at the front side of the deal (when you purchase the property).

If you're buying the property all cash:

Fees to expect upon closing:

- Title fees

- Filing and Recording fees with the county

- Any HOA fees associated with transferring the property

- And any Insurance that you might get (since you are buying it cash and it is your funds, you can decide if you want an insurance policy or not, however, I advise that you get some type of short term policy for your own protection should something happen)

Paying cash can save you a lot in fees because you don’t have any lender-associated costs or interest payments throughout the holding time.

A good rough estimate with a straight cash transaction on the front buying side is

$800-$1,500 depending on the title company that is used. This is not including any insurance policy, strictly your closing costs on the property. Insurance will be on top of this and on a home in FL around 200K you can expect it to be roughly $1,200- $1,500 (varying on location and the type of policy you get).

Now focusing on when using a hard lender which is where things start to get pricy $$$.

Typical hard Lender fees to expect:

- 2-3 points upfront (points are a percentage of the loan amount, to 3 points will be 3% of the loan amount)

- 10%-12% interest on the loan amount

EXAMPLE:

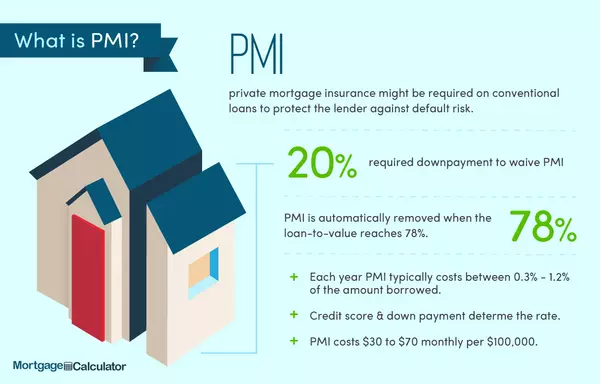

- 200K HOUSE - we will say they are requiring you to put 20% for simplicity's sake so the loan amount will be $160,000

- Of that, they are going to want 2-3 points upfront

- Basing it off of 3 points: that is $4,800

- With monthly interest payments of $1,600/ monthly (you take $160,000 * 12% / 12 months and then multiply that by how long you hold the property. In this case, we will say it will take you 4 months from the time you buy the property to the time you sell the property [holding costs]).

- Over the term of the project - we will estimate 4 months = $6,400

- So with your closing costs ($800 [title fees and recording fees])+ insurance ($1,200) + loan fees upfront ($4,800) and holding fees for interest ($6,400) = your looking at $13,200 in soft costs and interest

That's strictly fees associated with acquiring the property and holding fees over the terms of the project.

Now, couple that with your soft costs upon closing and selling the property.

As a seller, you can expect to pay roughly 2% in closing costs and 5-6% for real estate commissions. So as an example, We will say that you are anticipating your ARV (After renovation Value) of the property is $360,000. This is determined from running comps on similar homes that have been updated relative to your home (within a .5-1-mile radius)

Based off of selling the property at $360,000, your selling fees will be 2% closing costs + 6% commissions, which puts you at 8% ($28,800) total closing fees. Subtracting that from your sale price of $360,000 will net you = $331,200

Now putting it all together:

Let's say you ended up spending: 75k on renovations

Upfront you paid 200k for the property

-You paid for the hard $ loan: $13,200 for soft costs and interest for the term of the project

-You invested 75k in renovations

So you are all in the deal at $288,200

($200,000 [purchase price] + $13,200 [buy side soft costs and interest] + $75,000 [Reno budget] = $288,200)

Then circling back after closing fees and commission on the sell side, Your net number is $331,200

(sale price of $360,000 will net you = $331,200)

Now you take the net of $331,200 - $288,200 = PROFIT OF $43,000

Now that example is still a decently solid deal in today's market.. but if the spread is a bit tighter.. the soft costs and loan fees can really kill a deal if the spread isn’t big enough. I hope that’s helpful guys! If you are interested in investing in the Tampa Bay market, whether it be flipping, buy and holds, multi-family, etc., give me a shout & we are more than happy to help. If you have any questions about anything real estate wise please feel free to reach out! See y’all on the flip side!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "