Building a Real Estate Investment Portfolio

Building a Real Estate Investment Portfolio

Building a real estate investment portfolio can be a lucrative endeavor, but it requires careful planning and execution. An investment portfolio involves strategically acquiring and managing a collection of properties to achieve financial goals. It's a structured approach to real estate investing that aims to generate passive income, capitalize on property appreciation, and create long-term wealth. Here are some steps to help you get started:

-

Set Your Goals: Determine your investment goals. Are you looking for rental income, long-term appreciation, or a combination of both? Understanding your objectives will help shape your investment strategy.

-

Research Markets: Research various real estate markets to identify areas with potential for growth. Consider factors like job growth, population trends, local economy, and infrastructure development.

-

Define Your Budget: Determine how much capital you have available for investment. This will guide your property choices and financing options.

-

Select Property Types: Decide on the types of properties you want to invest in, such as single-family homes, multi-unit properties, commercial properties, or even real estate investment trusts (REITs).

-

Analyze Potential Properties: Conduct thorough due diligence on potential properties. Evaluate factors like location, property condition, rental potential, property management requirements, and potential appreciation.

-

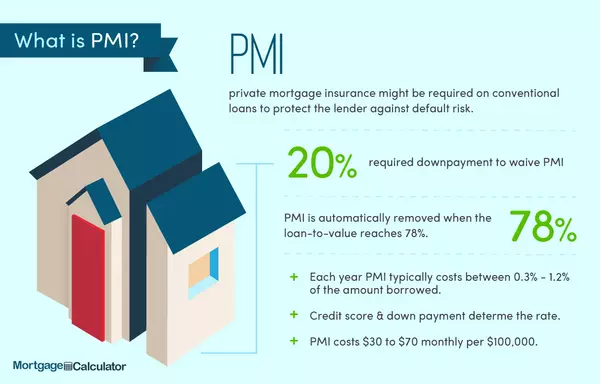

Financing Options: Explore financing options such as traditional mortgages, private lenders, partnerships, or leveraging existing properties. Understand interest rates, terms, and down payment requirements.

-

Create a Diversified Portfolio: Diversification helps reduce risk. Consider investing in different property types and locations to ensure that your portfolio is well-rounded.

-

Property Management: Decide whether you'll manage the properties yourself or hire a property management company. Effective management is crucial for rental income and property maintenance.

-

Investment Strategy: Decide on your investment strategy. Are you looking for buy-and-hold properties, fix-and-flip opportunities, or a combination of strategies?

-

Risk Assessment: Understand the risks associated with real estate investment, such as market fluctuations, tenant turnover, maintenance costs, and interest rate changes. Have contingency plans in place.

-

Legal and Tax Considerations: Consult with legal and tax professionals to ensure you're compliant with local laws and to optimize your tax strategy. Real estate investments have tax implications that can impact your overall returns.

-

Exit Strategy: Plan how you'll exit your investments when the time comes. Will you sell, refinance, or continue holding? Having a clear exit strategy helps you make informed decisions.

-

Continuous Learning: Stay informed about real estate trends, market shifts, and investment strategies. Attend seminars, read books, and network with other investors.

-

Monitor and Adjust: Regularly review your portfolio's performance and adjust your strategy as needed. Market conditions change, and you should be prepared to adapt.

-

Patience and Long-Term Perspective: Real estate investment is a long-term game. Be patient, and don't expect immediate results. Over time, well-selected properties can provide substantial returns.

Remember that real estate investment involves risks, and success requires careful planning, research, and ongoing management. It's advisable to seek advice from experienced investors or professionals before making significant investment decisions.

Building a real estate investment portfolio involves careful consideration of several key factors. Let's delve deeper into each factor:

Property Types:

-

Residential Properties: These include single-family homes, condominiums, townhouses, and multi-family units. Residential properties often offer steady rental income and potential for appreciation.

-

Commercial Properties: This category includes office buildings, retail spaces, industrial properties, and warehouses. Commercial properties can offer higher rental yields but may involve more complex management.

-

Mixed-Use Properties: These combine residential and commercial spaces in a single property. They can diversify your income streams.

-

Vacation Rentals: Properties in popular tourist destinations can generate seasonal rental income but may require active management.

Locations:

-

Urban vs. Suburban vs. Rural: Consider the location's proximity to job centers, amenities, schools, and transportation options. Urban areas may offer higher rental demand, while suburban or rural locations may provide lower costs and potential for growth.

-

Economic Growth: Invest in areas with strong job growth, diverse industries, and a growing population. Research local economic indicators and development plans.

-

Infrastructure and Development: Locations with improving infrastructure, transportation, and public services can attract tenants and appreciate in value.

-

Market Stability: Analyze historical market trends and forecasted growth to identify stable markets with long-term potential.

Risk Tolerance:

-

Conservative: Opt for lower-risk investments, such as stable rental properties in established neighborhoods. Prioritize steady cash flow and capital preservation.

-

Moderate: Balance between risk and reward by considering a mix of property types and locations. Look for opportunities with potential for appreciation and decent cash flow.

-

Aggressive: Seek higher returns through strategies like fix-and-flip, development projects, or value-add properties. These strategies may involve more risk and active management.

Investment Goals:

-

Cash Flow: If your primary goal is regular income, focus on properties with consistent rental demand and positive cash flow.

-

Appreciation: For long-term wealth accumulation, invest in properties located in areas with strong potential for value appreciation.

-

Portfolio Diversification: Diversify across property types and locations to spread risk and balance your portfolio's performance.

-

Tax Benefits: Consider properties that offer tax advantages, such as depreciation deductions and 1031 exchanges (in the U.S.).

-

Short-Term vs. Long-Term: Determine whether you're looking for short-term gains (fix-and-flip) or long-term wealth building (buy-and-hold).

Remember, your real estate investment portfolio should align with your overall financial plan. Regularly reassess your portfolio, stay informed about market trends, and adjust your strategy as needed. Additionally, seek guidance from financial advisors, real estate professionals, and experienced investors to make informed decisions that match your risk tolerance and investment goals.

If you’re interested in investing in the booming Tampa Bay market, The Praise Team would love to be a resource for helping you achieve your investment goals. Contact Tatum Praise today at 813.528.1121 or at Tatum@mkarealty.com to get started today!

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "